After recognising in my previous post that Michael Arrington has successfully captured the dynamic of the mass media to pioneer new media, my mind asked how did this guy do it. With some time on my hands, I looked into what I think is one of the most remarkable stories to occur in the recent tech boom that was Web 2.0 (yep, that’s past tense – it’s an innovation era that now has closed). How "a nobody ‚Äî a former attorney and entrepreneur who, at 35, looked as if he might never hit it big " became one of Time’s 100 most influential people in the world. I’ve never interacted with Arrington, although I know plenty of people that know him well (through the Aussie mafia that grace the Valley). So this is coming from a completely objective but aware view. An outside view with purely the public record to track his success. Let’s see what the evidence tells us.

The accidental start-up

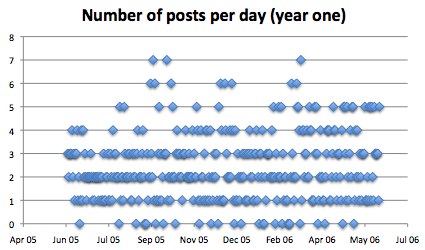

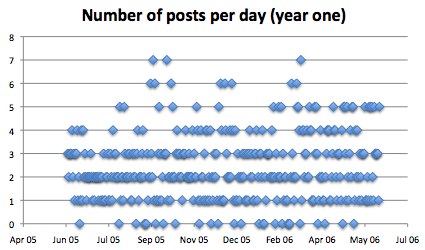

Reading through the archives of his main blog TechCrunch.com and his companion blog CrunchNotes.com, I came to realise his success could be identified as early as his first five months from the first post written. He launched TechCrunch.com on the 11th June 2005 with posts released daily if not multiple times per day. The blog averaged 5 posts every two days in its first year, with 879 posts (it was actually more, but a half dozen or so have since been removed).

His first post, which has since been removed (God bless the Internet archive), gives an insight into motivations for starting the blog.

TechCrunch is edited by Michael Arrington and Keith Teare, with frequent input from guest editors. It is part of the Archimedes Ventures network of companies.

Archimedes Ventures was at the time a two partner firm that specialised in the "development of companies focused on Web 2.0 technologies and solutions." The fact the page listed Teare and is marked as part of Archimedes Ventures network of companies suggests this was a conscious business development effort on the part of Arrington. As he would later reveal, he was inspired by Dave Winer who said: ‚Äúif you are going to build a new company, go to the trouble of actually researching what other companies have already done." Several months later in October, he posted an announcement that his startup Edgeio would be live soon, validating that TechCrunch wasn’t so much a "hobby" but a need to understand your market. Indeed, it seems TechCrunch just became a more formalised affair as he had been posting research into potential competitors on his personal blog publicly from March 2005 – and by the time he launched TechCrunch there were already four employees at Edgeio. No doubt, exposure and networking like any smart businessman was part of his agenda as well, which perhaps is why we saw a transition from a personal site to a TechCrunch brand (more on community building later).

On October 2005, TechCrunch was ranked the 566th blog by Technorati based on the amount of links it received from other websites. In December of that year, its ranking had climbed to 96th. One year on, in June 2006, it became the 4th most linked-to blog and has subsequently maintained its status as number 2 (not being able to beat another new media mogul Arianna Huffington who dominates the table, but that’s a story for another time).

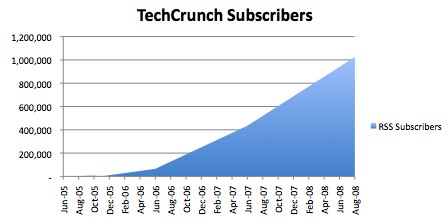

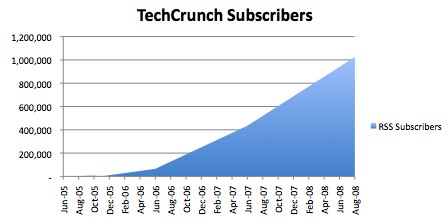

The above graph shows an explosion, but it’s the first year that tells the story which forms the basis of this post:

Over that first year, 23,713 comments had been left, with around 1-2 million page views per month. However as the figures show, it was the first six months where this research turned into a prospective business ("help "), with subsequent months and years simply consolidating his growth: by year two, there were 2,000 more posts (double the output of the previous year); 115,608 comments and trackbacks in total (an average of 40 per post); and 435,000 RSS subscribers. Pages views in the month leading up to the 24th month in operation were 4.5 million, twice what it was the previous year. In September 2008, over a million people subscribed to the blog.

So how did he do it?

Compared to his peers/competitors, he joined the game quite late, and yet he is absolutely smashing them. Same software in some cases and same focus. The question is, what did Arrington do that others didn’t?

Whilst the metrics might track his growth, they don’t track how he did it, which has less to do with Search Engine Optimisation and more to do with hyping up a boom. Below I describe what I think are the Critical Success Factors that made TechCrunch what it is today.

1) Events.

TechCrunch wasn’t just a blog; it was a host. Early on, there were events hosted at Arrington’s house where people could network and mingle. It would be a mistake to think that TechCrunch later on got into the conference business as an alternative revenue stream, but the reality is, social networking was being organised in the real world in parallel to the online blog from as early as August 2005. To create a new blog and have 63 people subscribed to it within a week indicates a lot of offline activity to get those subscribers. The social meet ups reinforced his readership base.

2) Web2.0.

Arrington saw a tide building for a second tech boom and formed a loose group of allies promoting this tide. Add to the mix some existing high profile personal brands like Dave Winer and Robert Scoble – and in the process, you build your own personal brand. To use his words, he saw a parade and got in front of it.

When Tim O’Reily coined “Web 2.0”, it was a buzz-speak marketing word. What Arrington did was successfully exploit this dynamic by recognising the rising investment trend occurring. He built a community around Web 2.0 by being its tireless champion and channeling existing energies. And as the community grew, so did he. He realised that what goes down, goes back up again – and by tapping into this growth, he could grow with it. If this second boom was anything like the first, being at the front of it would be such a good career move that it probably didn’t even need to be said.

3) Excellent content.

Don’t underestimate the difference quality content has. Arrington has an analytical mind and is a clear communicator – he is a lawyer after all. Intelligence and an ability to communicate will beat even the most experienced journalist. I‚Äôve been told that Arrington doesn‚Äôt understand tech, or at least makes a convincing image of not getting it, which probably explains the why he writes in plain English – even in the conversational style of writing that blogging is associated with, good clear English is rare to find. More importantly, he understood what all publishers have long known: good content is not just about the words. As Scoble highlighted long ago, one of the reasons that made Arrington such a popular writer is the simple use of images to break up the text.

No doubt, Arrington’s previous staff writers, ones I am familiar with like Nik Cubrilovic, Duncan Riley and Marshall Kirkpatrick, made a big difference in TechCrunch’s growth: Kirkpatrick’s ground-breaking RSS and research skills to find news, Cubrilovic’s Arrington-style writing ability, and Riley’s industry relationships to often break news – is how they made compelling content. However, Arrington quite uniquely stands out and it‚Äôs why when he tried to take a break and to focus on the business side, he was pulled back in to raise the quality. TechCrunch is Mike Arrington: it’s been proven you can’t separate the two (at least, yet).

4) The media dynamic.

As I recently argued, the mass media at its core is about playing a game, but in the context of web 2.0 it is about understanding the dynamics of a market place. He had access to Venture Capitalists (VCs) as he was a corporate lawyer as well as an entrepreneur with experience to boot Рaccess that other entrepreneurs quite simply didn’t have.

He was able to successfully take advantage of the VC paranoia that they might miss the next Google or Facebook. They literally were desperate to hear about the next big thing. For them, Arrington was a deal-type lawyer who would review things in plain English and present it with pretty pictures. On the flip side, you had entrepreneurs dying to get in front of these VCs as well as general exposure for their start-up. When Arrington decided to put advertising on the blog, it was a natural progression: entrepreneurs wanted to get exposure to VCs, future employees, and buzz amongst their peers. People on the other hand, are willing to consume this content because it’s free market research for them – catering in the audience for both investor and the entrepreneur. Powerful stuff? God yeah – that’s the kind of captive audience that’s addicted to crack cocaine.

To give you an idea of impact, I was told by an entrepreneur whose company was profiled in that first six months, that they got something like 30 VC calls and e-mails over a holiday period. After less than three weeks, they had Kleiner Perkins Caufield & Byers email, say "Hi, just another VC here. Can we meet next Thursday?". They had a list of meetings that kept them going for weeks. My own personal experience this year through the DataPortability Project saw first hand what exposure and support from TechCrunch could do, and suffice to say, it’s impressive. We had VCs wanting to talk to us about data portability, even though we‚Äôre non-profit!

This offline social networking is key to what ultimately became an online social media business. What’s very telling is a comment left by Valley legend Dave Winer, a man Arrington repeatedly showed admiration for and I am sure his relationship is what gave him a boost at the start. It reflects several things, but foremost, Arrington had a lot of goodwill in the community as a leader of the industry by existing heavy weights. He connected the various participants in what ultimately is a marketplace. Forget about Edgeio – this was the making of a new media business that would show the dying mass media what the future looks like for their industry. TechCrunch became the channel of choice for so many people to get their voice heard for competitive, strategic and ego reasons.

Concluding thoughts

TechCrunch started as a hobby and research project to test a bunch of the stuff he’d been reading about in the Web2.0 space. After the crash, he pretty much dropped out and watched a lot of college football – he needed a way to get back into it. Arrington probably knew he could write well, but I don’t think he realised how much of an impact his ability could have. The use of images in content, and the frequency of his posts made TechCrunch in the first six months, combined with offline social networking, the positioning as a champion of the Web 2.0 community, and exploiting the dynamic of a marketplace is what made him what he is. By the end of 2006, I don’t think Edgeio got much of Arrington’s attention at all – he’d been hooked by the excitement of writing, leading opinion and eventually, the power that attracts people to positions of note and influence, whether it be media, celebrity, business or politics.

This post only touches on the surface, as the Critical Success Factors in that first year do not give a full picture. Arrington‚Äôs involvement with the presidential primaries process, his disruptive influence with DEMO through the TC40/50, the Crunchies and even the people who keep trying to take him down add a further dimension to the TechCrunch story. He’s a man with more haters than Murdoch, but that’s doesn’t make him any less brilliant.

Arrington can get right up the nose of people with massive vested interests, and he loves to stir the pot – like the traditional press practice, controversy sells. Living in a massive rented house with all but a big dog, he can pretty much operate without fear. If it all exploded tomorrow, he’d probably have a beer, and enjoy a good long holiday and another season of college football. That’s what makes a journalist fearless, and that, combined with his obvious passion for the sector and the power he wields makes for a pretty dynamic combo.

He’s made no secret of his desire to be bigger than C|Net (without having to cop the overheads of their business model). Take out download.com, and I think it safe to say he’s reached that: maybe it’s time he puts his eyes on something a bit bigger. Although I doubt he needs to be told that – he’s already making history along with another select few, who through raw talent are pioneering “new media”, ready to replace the financially bankrupt mass media as the influencers in our society.