Back in 2009, I attended the Identity Common‘s annual conference and met a gentlemen who pitched me his HTML5 social networking app. HTML5 was the flashy new technology of the time and social networking was all the rage due to Twitter and Facebook. Burbn is what it was called and even though I thought it had no commercial value, it was still a memorable encounter. One year later, Burbrn would pivot to Instagram and that gentleman, Kevin Systrom, would sell his company for a billion years later.

Although I was oblivious to meeting the man who would create one of the world’s most impactful social media products, I was nevertheless aware of a coming storm. A year before that conference for example, I wrote a blog post thanking 2008 because we finally had a name for new media, “social media”. A term that was nascent back then but which now dominates our way of life. If you read that history I did, I also correctly predicted our friends would filter the world for us. What I never saw coming was how nation states would commit information warfare, where among many other things these same friends of mine were repeating propaganda which shaped our views.

“30282 Super Secret Police Enforcer” by Masked Builder is licensed under CC BY 2.0

A wakeup call

This information warfare is apparent on social media these days, suffocating these platforms. I’m currently in Russia and so I rely on a VPN to get access to things as unremarkable as LinkedIn. While this fact is not the reason why Instagram just disabled my account, it’s certainly a factor. I was trying to curate my connections as after a decade of following people my feed was crowded. Meaningful connection with everyone was not possible and I missed the content of those I did care about, making it slightly unusable. (Instagram even understood this as I would get frequent suggestions I create a new account to connect better with the people close me, which I think might be how this thought even got into my head.)

This activity triggered some type of automated alert, which appears to be part of their new way to target “unauthentic” accounts. Instagram said they are reviewing it as a security alert over the next 24 hours. And for a reasons I don’t know, I was then told my account was deleted.

(My offences if I had to incriminate myself is I used an app to help with analysing my friends as it gave better insights with my manual clean up, I’m in Russia which is not where most of my friends are and one of Facebook’s new triggers, and I have a post eating ice-cream to the tune of the anthem of the Soviet Union, which would be identified as a copyright violation to someone who doesn’t understand copyright law.)

Done. Finished. No link to appeal. Never mind I’ve been a good citizen for 10 years: bye bye. And no, we won’t say why, just do not pass go, do not collect your belongings. It’s been a week with no ability to rectify it but that’s for another day because what matters is this is what I was effectively told at first. Suspicious logins, performing a few unfollowing actions and potentially copyright: my account was swatted like a fly that was categorised as a wasp when all I am is a bee trying to make some honey.

Winding back a bit and why I have a post eating Soviet ice-cream, “stories” was a transformational change to Instagram, a concept Instagram copied from Snapchat 5 years ago. When Snapchat made headlines, I’ll be honest: I could not understood why ephemeral content had value. But it suddenly came to life for me with Instagram as I learned content is powerful when generating an experience to connect with people. (A smaller portion of my network is on Snapchat, so the same functionality has less value.) Parallel to this, I saw the increased migration of my network from Facebook due to its privacy scandals. The 500-600ish connections I’ve made there over time, the hundreds of posts I had made including pictures of my children from my old phone or archived videos trying to perfect my technique on one of my hobbies, has meant it only grew in value.

But that’s not why my life was impacted. This is simply a pretext to how how the messaging system grew to become so important to me. The life sharing through stories and private messages as a result of it became a feedback loop where I reconnected with people. To the point where it even built a habit of deferring there first. In some cases, it’s the sole way of me connecting and communicating with people, like former colleagues who’s number I no longer have, former classmates for the reunion I’m organising, and even my yoga teacher in Russia where I (repeatedly) tell her when I’m running late (and boy, was I late this week). This is a utility to my life but even more so, what underlies my human connection.

And just like that, my ability to connect — and prized memories captured as content that I don’t have anywhere else — just disappeared. If you find this entertaining about how I could be so emotionally invested with a product, then consider the panic attack you may have had once in your life when you lost your phone (that had no backup). Swap this out imagine your Facebook or your phone contact list or your email account or whatever you use to maintain human connection– what if today out of nowhere, it was just deleted, terminated. How would you feel about that? Sure, you can start all over again but good luck trying to remember the surname of that dude that you really need to speak to right now that might help you get a job or give advice about going through an illness or to help you locate someone else.

“Museum of Communications” by Cargo Cult is licensed under CC BY 2.0

Who has the right to determine who you talk to?

When Twitter earlier this year made the decision to ban Donald Trump on Twitter, it set off a firestorm debate about freedom of speech which is still raging. Regardless of the reason, as freedom of speech in my eyes is a concept that is meant to protect you from oppression of the government, I felt unaffected though as a precedent it was alarming. Having someone in government lose their ability to communicate suits me fine because I don’t want to hear from them in the first place. But it raised a question that we have Trump to thank for pushing the limits on: who has power to make that decision? Twitter by law, had the right to do what they did. However, that decision may one day be regarded as a turning point. Silicon Valley, such as people in my circle who very much are leaders in the industry, and Washington, always talked about in the news, know that change to Section 230 is not if but when.

As I follow Instagram’s painful process to appeal their decision, and learn about how they operate, this incident has made me reflect that because of how overwhelmed they are, they clamp down even on regular people who have done little wrong. That brute force approach might superficially solve a problem of theirs but it creates others. If I didn’t have my intellectual property in the form of photos, videos and contacts on my account and this wasn’t a primary means for me to communicate with people, I probably would not give a damn. But I do: this actually affects my life.

Instagram could be a little smarter. Rather than shut out people, revoking users posting privileges is penalty enough with little downside risk. And yes misinformation and information warfare is a whole big problem that I’m just glossing over now. But the people we meet and the technology we use to connect with them is not a gimmick anymore: it’s what underlies our humanity in the information age. Instagram shutting down my account I consider worse than someone tampering with my postal mail. (Intentionally opening, intercepting or hiding someone else’s mail is the felony crime of mail theft in the US.)

As I said in 2008: “If my social graph is what filters my world, then my ability to access and control that graph is the equivalent to the Mass Media’s cry of ensuring freedom of the press.” In 2021, I’m going to say access to that graph now underlies our human connection and any restrictions on it will result in a revolt from users or government wanting to regulate one day.

The future is decentralised

The ability to communicate interpersonally with someone, or to broadcast to a group of people, or to discuss as a group — like what Instagram offers — is too important to let any one entity be able to control. Cryptography and Blockchain offer a path to building decentralised applications which is a good way to protect against abuse (or incompetence) by a centralised authority.

“2015-01-16 22-31-05 NodeXL Graph Server blockchain” by Marc_Smith is licensed under CC BY 2.0

That’s not an original idea. Web innovators over a decade ago with a focus on open standards, including the freshly created oAuth that underpins many applications these days, proposed that the future of social networking should be based on the principles of the decentralised internet. They unfortunately gave up to move onto other projects but the vision is sound. Where your relationships to other people and your ability to communicate with them cannot be controlled by any other entity other than the people involved. We already have the technology to do it but obviously implementation is tricky. It’s also something we should not take lightly: when someone works it out, it’s going to be the stuff that will one day topple governments. You would have laughed if I said that in 2008 but it was three years later that social media did that with the Arab Spring. This would be on a whole other level.

If Systrom didn’t sell out as early as he did and went back to his original vision of Burbn, maybe Instagram would have become that. Now that it’s a Facebook product, what is more likely, is that the management of Facebook either can’t understand how this trend is a threat or understands too well because it will disrupt their monopoly but the result is the same: nothing. That almost doesn’t matter because if information warfare continues to disrupt the operation of social media, this heavy handed policing will only continue and correspondingly there will be increased backlash due to the frustrated user base (it’s already happening with the valuable content creators).

Perhaps history will repeat itself where hubris will dismiss the entrepreneurs who will disrupt their product, like how Facebook tried to do with Instagram initially. That disruption sounds like audio right now thanks to the chatter by Clubhouse. However, until we see disruption on the architectural level that can put all the components together in a decentralised way, this is all just the warm up act.

More likely it will take one random person getting disabled, to piss them off enough where they will make that vision happen sooner. But until that happens, we ain’t seen nothing yet.

Update: September 7 2021

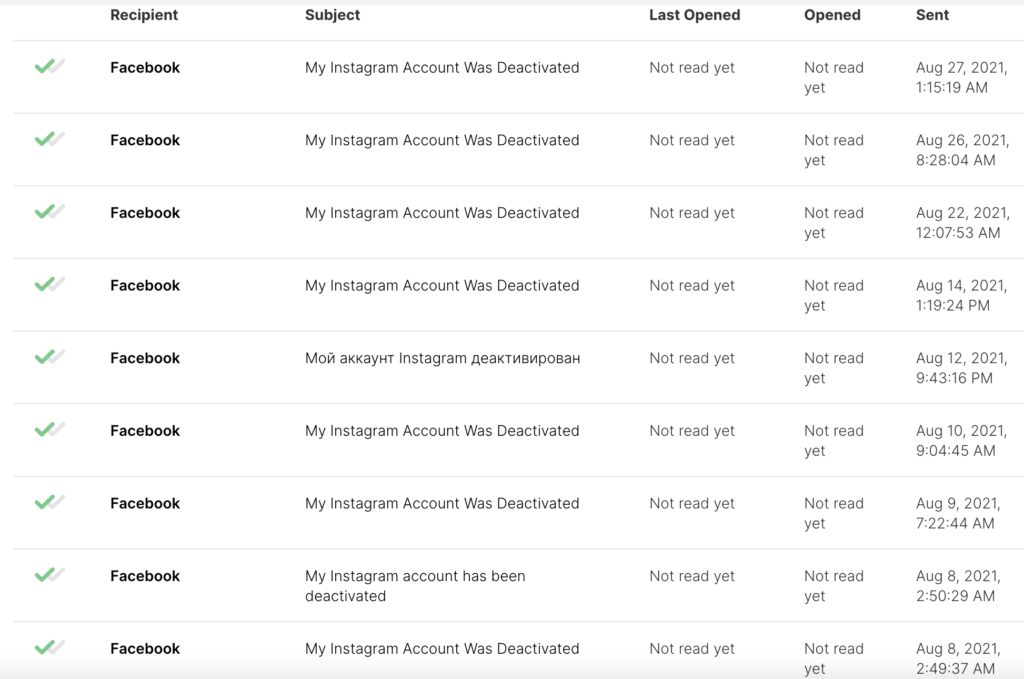

Given the thousands of people on the Internet that this is happening to, where there is an entire cottage industry of agencies offerings to help you get your account again for a fee, I thought I’d share what happened to me.

- After initially been shown the wall, I later could apply via a link to say a mistake had happened. I had to put my name, email, username. An email would be sent, sometimes immediately, other times hours later, where I had to take a picture with the code.

- I did this daily and with different email accounts. The first few times, I responded with a different email account and after two times they would stop sending me an email when I requested it. But after a week and/or sending from the right email, as in the email I put on the form, it started working again.

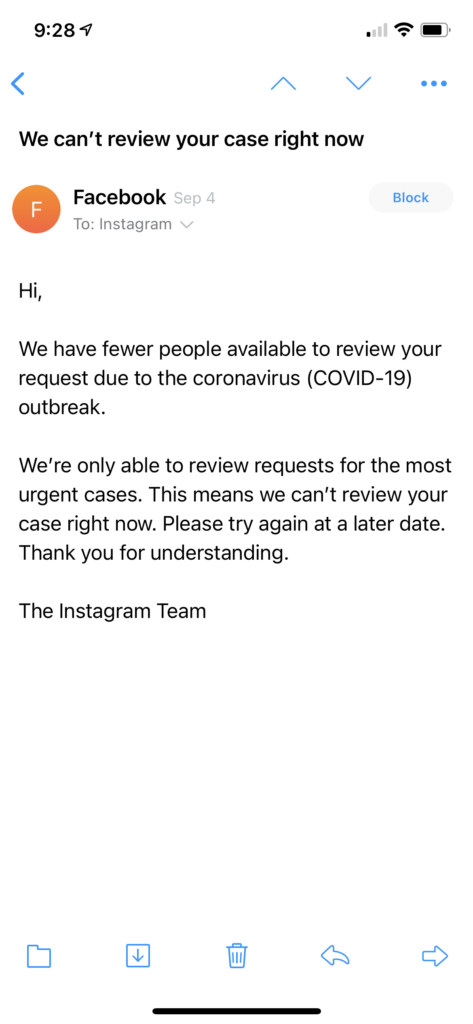

- However after fixing that and another issue, where I could see no reason why nothing was wrong I started tracking my emails. Here’s the interesting thing: none of my tracked emails have been opened. As I didn’t track the first few, I can’t say what happened there but this just proved to me the Facebook team is overwhelmed due to their automated fraud platform that’s shutting so many accounts

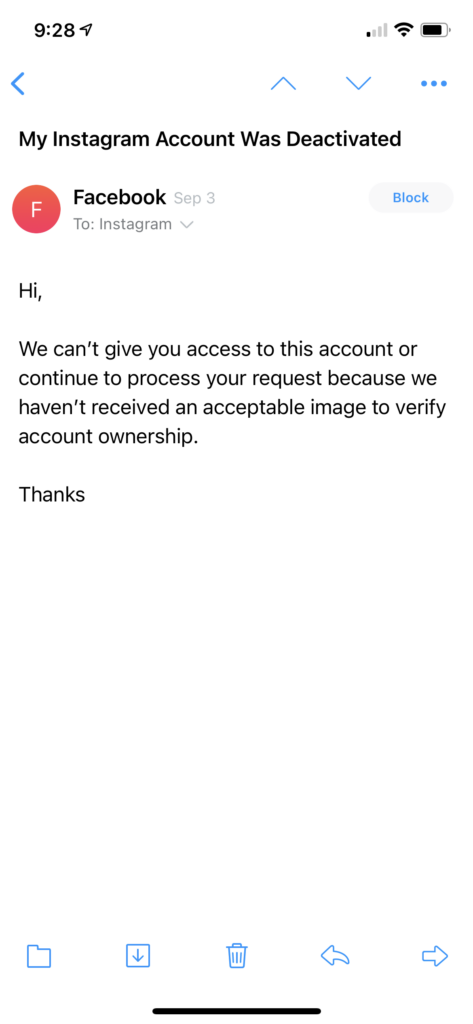

A few weeks pass and then the other day I get this email. Which I thought was weird, but when remembering my first two photos were sent from a different email, told me they must be about a month backed up clearing the queue.

And bam, the very next day — the sympathy apology email. Looks like my queue was overwhelming them.

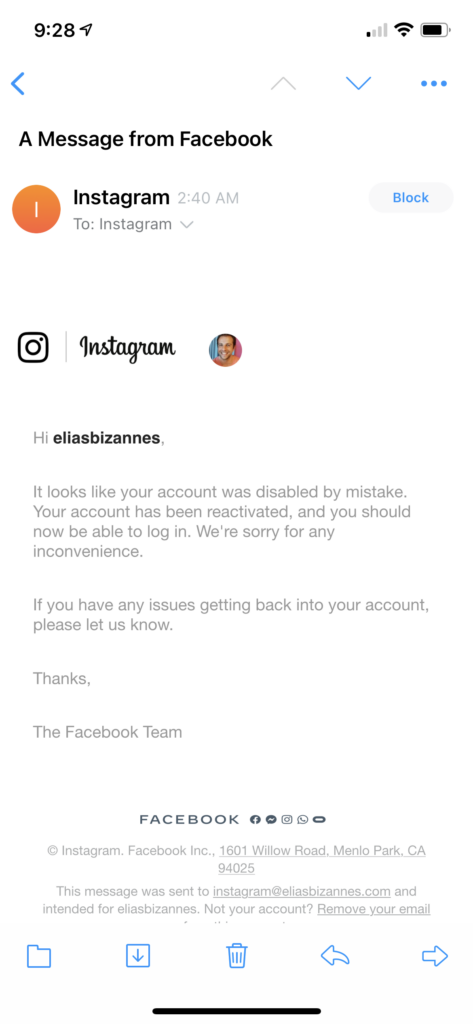

Then a few days later, with my daily requests waning, I get this. (Notice that it was sent 2.40am, which means whoever did this is not working at Facebook HQ…which means this happens so often it’s been in or out-sourced)

Why now? Well, other than just giving it time something else happened. I started using a new Instagram account and these above emails happened around the same time I shared my first story which was connected to my Facebook account. It’s almost like the second story I shared triggered the reactivation. Maybe this is a coincidence, but given their automated spam detection platform is what shut my account in the first place, I would not be surprised if there is a correlation. Ultimately, they are just trying to prove you are a real human with a real account.

…And the real humans trying to keep up with this automated Facebook platform are getting seriously burnt out.